- Mojo Report

- Posts

- Mojo Report #10

Mojo Report #10

Larry BFF now?

Mojo Report #10

Your weekly DeFi update. The good stuff, but not financial advice!

This is why I hold mainly ETH, as I told you in previous Reports.

JUST IN: 🇺🇸 $9 trillion asset manager BlackRock registers Ethereum Trust in Delaware.

— Watcher.Guru (@WatcherGuru)

3:11 PM • Nov 9, 2023

I was hoping for ETH ETF or trust to kick off the ETH narrative. As I told you, I expected that ETH won’t stay behind BTC for long. However, I'm surprised this came so early.

Everyone is so focused on the BTC ETF and often the first gold ETFs are used as an example of what will happen.

Controversial Opinion:

The first gold ETFs haven't been the cause for the gold run.

And the BTC ETFs won't be the cause for the BTC run.

Correlation is NOT causation!

These ETFs are just a vehicle, nothing more. twitter.com/i/web/status/1…

— mysexylife.eth (@My_SexyLife)

7:03 PM • Oct 29, 2023

I believe the first American traded gold ETF in 2004 just had a small impact on the price. And the run up was mainly caused by the 2008 financial crisis.

Of course, it flew before. But the trend was already there and it looks similar to the movement in ‘77.

In other words ETFs are just a vehicle, a psychological trigger for something that would happen anyway, especially with the upcoming financial crisis… ups spoiler.

And the same applies to BTC. It would run similar without an ETF. It just happens faster with the ETF.

On-Chain Look

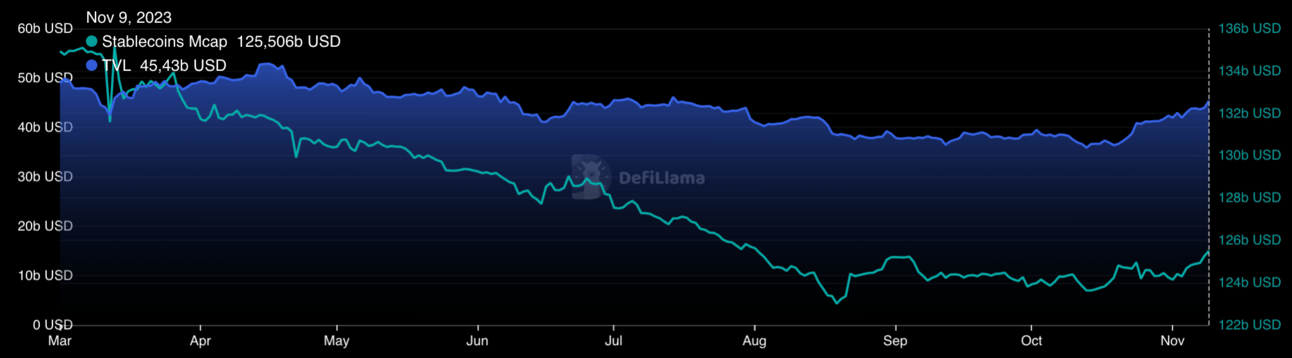

This is a picture we want to see. Stable inflows and TVL rising.

CEX 7D net Flows:

BTC -23k (-1.15%) flew out of exchanges.

ETH with some inflows today +88k, which makes -62k (-0.43%) less on CEXs

Chain 7D Flows:

Arbitrum with the most inflows of ~$44m, which is not surprising with ARB STIP in full swing.

OP with $15.5m on second and Gnosis on third place with ~$13m.

DeFi Updates

Another Oath eco project launched, Digit.

It’s basically a yield optimizer with some extra features.

If you haven’t yet, you should definitely dig more into the Oath eco-system. V2 launching soon and the first Oath Chapter AureliusFi will also be deployed on Mantle in the near future.

We’re officially live with digit.xyz!

On Digit, you can find the best yields for ERN, USDC, USDT, and DAI.

You’ll also find one-click UX, apple wallet support, portfolio management tools, and more. Stay tuned for a tutorial tomorrow.

Here are 9 things you need to… twitter.com/i/web/status/1…

— OATH Foundation (@OATHFoundation)

11:52 PM • Oct 24, 2023

You know I’m a big fan of CDPs and another interesting one is about to launch.

For some reason Arbitrum is pretty poor in such kind of protocols, so it’s even more pleasant that Seneca launches.

Seneca has raised 150 ETH in its fair launch and $SEN is currently trading around $0.45

I didn’t participate in the launch, neither did I buy yet. I’m just not a fan of buying a project without a fully and properly launched product.

Fair Launch Ended. ⌛️

Seneca's Fair Launch on @TheGemPad is closed!

150 $ETH raised, with 100% being added to $SEN liquidity.

Stay tuned for the TGE announcement. 🏛️ twitter.com/i/web/status/1…

— Seneca (@SenecaUSD)

3:10 PM • Nov 8, 2023

Don’t miss out on $TIME + $ARB incentives!

Borrowing $ARB brings you 68% rewards atm. Lend your borrowed $ARB again and you can make another 47% on top.

1/ Gm Time Travelers 🧑🚀

⏳ Premine of $TIME is LIVE!!! ⏳

Get ready to amplify your yields with boosted $TIME rewards! 🔊

🚨 Earn 5 digit APR on USDC 🚨

Let's dive in! (1/6) 🪂

— Timeswap ⏳ (@TimeswapLabs)

11:50 AM • Oct 20, 2023

Another Airdrop. Check if you’re eligible…

Today marks the unveiling of the Pyth Network Retrospective Airdrop.

This airdrop is a cross-chain program for the dedicated community of the Pyth oracle ecosystem.

Learn more below:

The program is an expression of deep appreciation for the dedicated Pyth Network stakeholder… twitter.com/i/web/status/1…— Pyth Network 🔮 (@PythNetwork)

10:13 AM • Nov 1, 2023

The SOL eco might be a good place to position.

Now $SOL has proven it's not dead.

If it reaches the TVL ath, that means a 20x for the whole eco-system 👀

And if you dream a little, you could say, it's like investing in $ETH in 2020.

That would mean 200x

Ok, I don't expect that! But the r/r ratio for the $SOL eco is def… twitter.com/i/web/status/1…

— mysexylife.eth (@My_SexyLife)

10:39 AM • Nov 9, 2023

The DeFiChain MetaChain is launching soon. After they fumbled the dToken system, I’m not so sure about it, but lets observe what will happen.

It’s very centralized, because most is running through Bake. But this could also be a strength. It very appealing for non-crypto people.

DeFiChain’s new #Ethereum Virtual Machine (EVM) layer, called MetaChain, marks a major evolution in its architecture.

With MetaChain, DeFiChain can now support EVM transactions while still keeping the security benefits of its UTXO model. How does it work?

DeFiChain introduced a… twitter.com/i/web/status/1…

— DeFiChain (@defichain)

10:32 AM • Nov 9, 2023

Investing

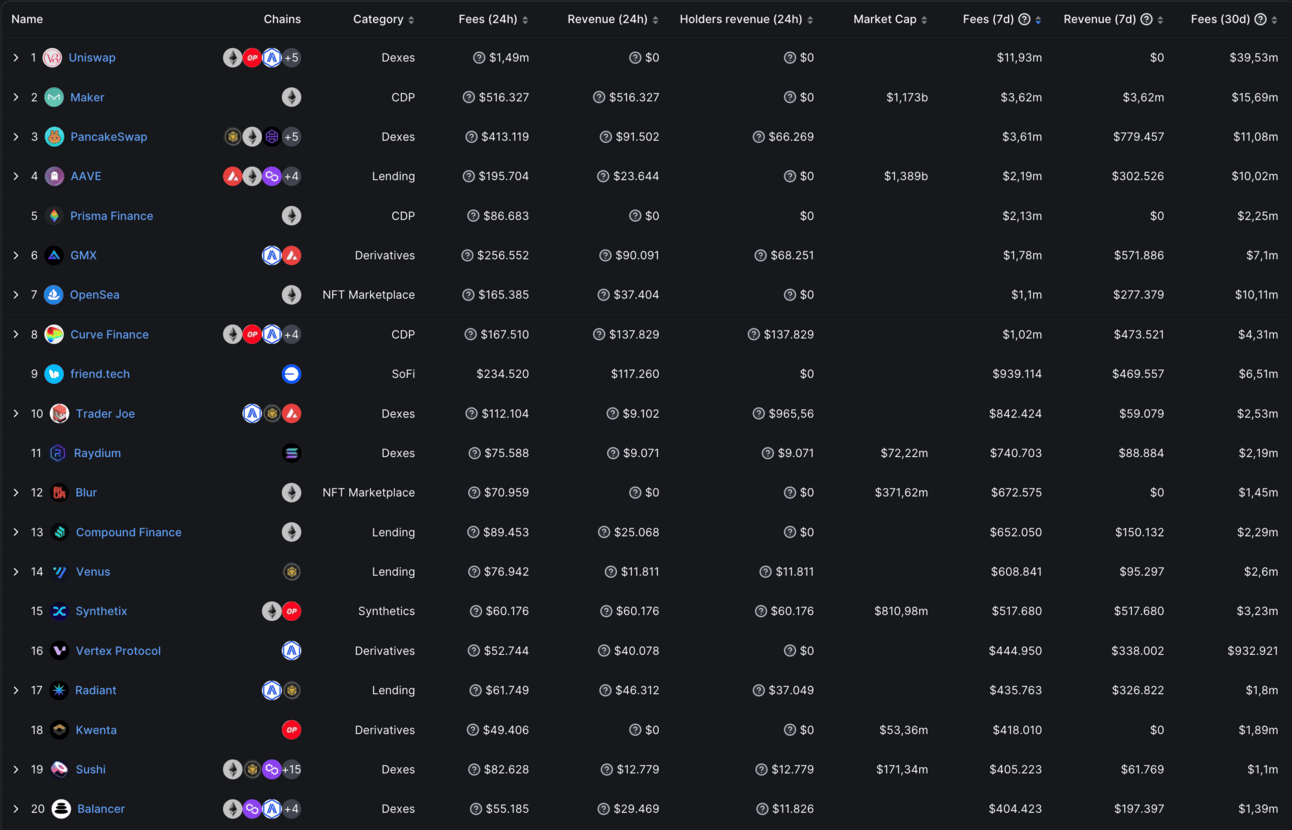

The only utility of a token people care about is making you money. Find strong projects that share profit with holders and you know what people want to hold.

Macro

China and Japan started to drop some stim-packs.

Japan to approve $110bn stimulus package to fight inflation

— Nikkei Asia (@NikkeiAsia)

12:22 AM • Nov 2, 2023

China:

• over $100 billi into the lending market

• rate cuts on mortgages

While Germany is already in a full recession, China could kick it off for the US as well. Not that it needs China for that, but it’s a good indicator to pull out before shit hits the fan.

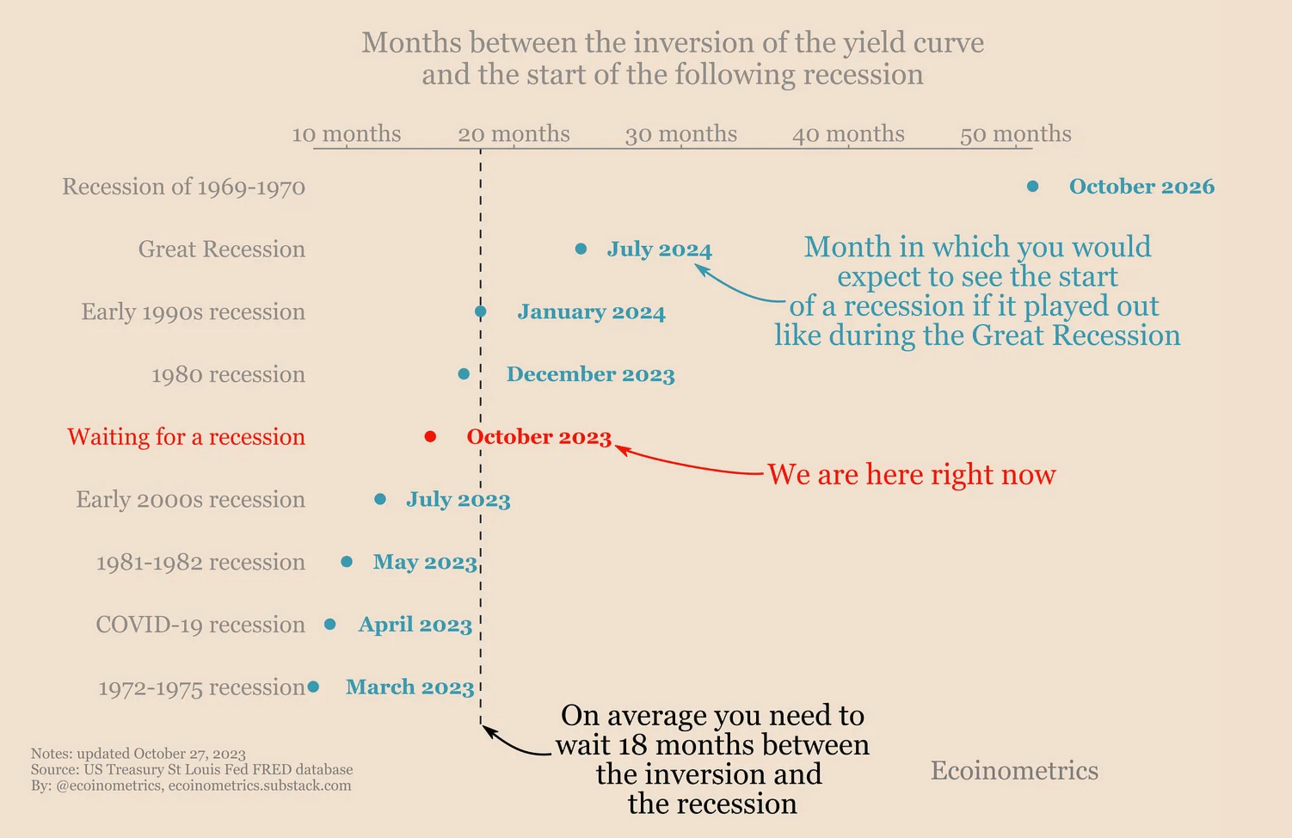

As I’ve mentioned before, the yield curve inversion is a solid indicator for predicting a recession. There’re just different time horizons until it hits.

When it arrives the FED has to print, but historically a pivot also caused a drop in the markets first.

Will the FED drag down BTC when it's pivoting?

Historically, this seems like the case.

But how low will it go and why?

Well, it's impossible to predict. We don't know when this will happen and what the price will be.

____________________But let's make a thesis.

The last… twitter.com/i/web/status/1…

— mysexylife.eth (@My_SexyLife)

8:06 AM • Nov 3, 2023

Stay Sexy!

I’d appreciate if you give me some feedback and what you like to read in this newsletter, so I can provide the best value for you! Just send me a DM on X or reply to this Mail.