- Mojo Report

- Posts

- Mojo Report #11

Mojo Report #11

Ridiculousness of Maximalism

Mojo Report #11

Your weekly DeFi update. The good stuff, but not financial advice!

The words that come out of maxi’s mouths are becoming more and more embarrassing.

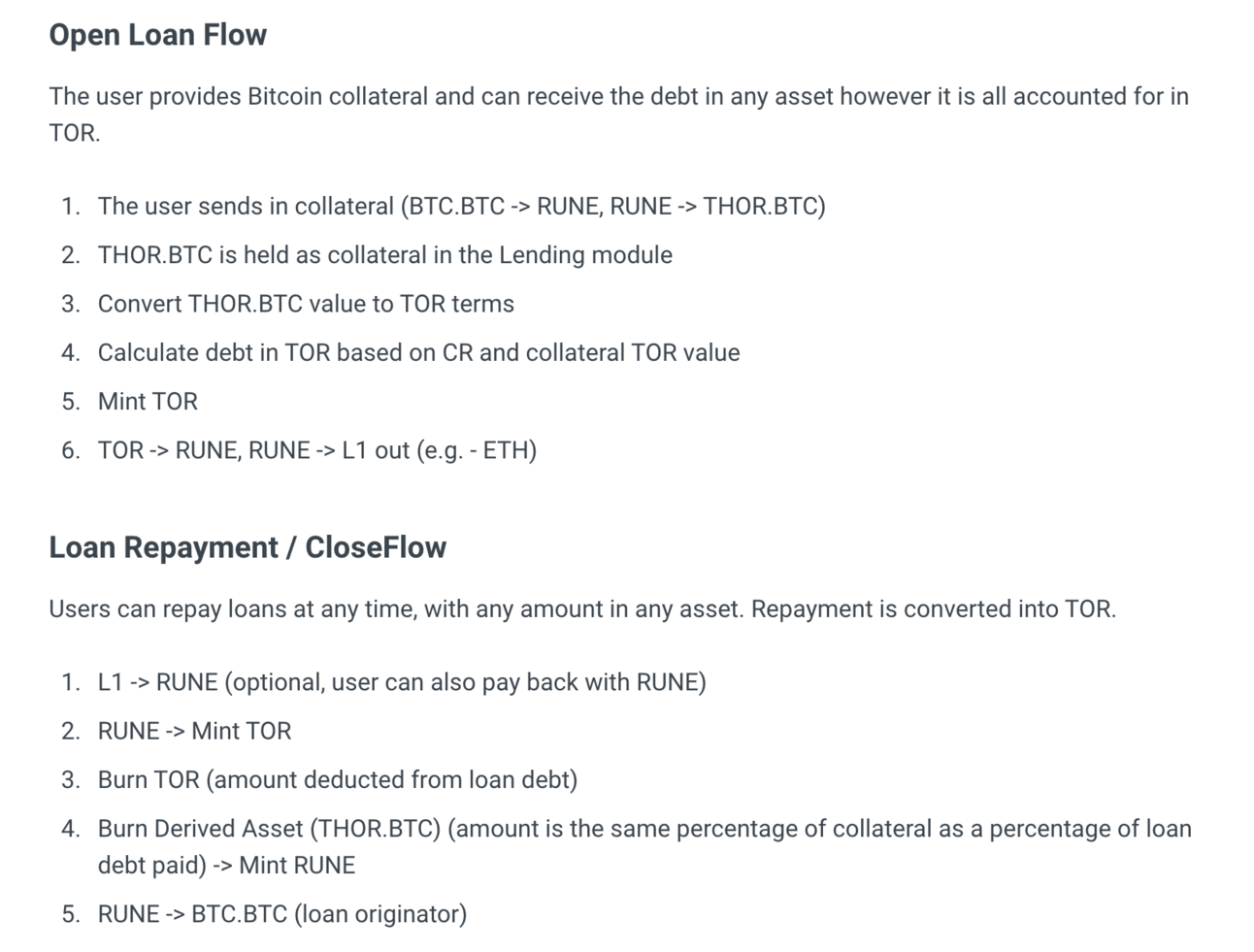

There’s a debate going around because of the high yield on the ThorChain.

Asking the question “if you don’t know where the yield comes from yada yada…” is always a smart thing! But not checking afterwards is a new level of stupidity.

The swap volume was over $1.1B last week 👀

Just point out real risks, like:

• another hack

• gov overreach (will nodes comply?)

• mechanics how lending works (your collateral assets are basically swapped for RUNE and then for derived assets, e.g. thor.btc, which is held as collateral)

If the underlying collateral rises in price and the loan is closed, an inflationary pressure is created on RUNE.

• Entering Savers pump RUNE due to its structure and vise versa.

If shit hits the fan, everyone wants to exit, which creates a price dump in RUNE.

But maxis won’t do that, because they’re a bunch of pathetic people larping in their bubble.

So whatever you do, don’t ever listen to a maxi! They barely have an understanding of anything.

On-Chain Look

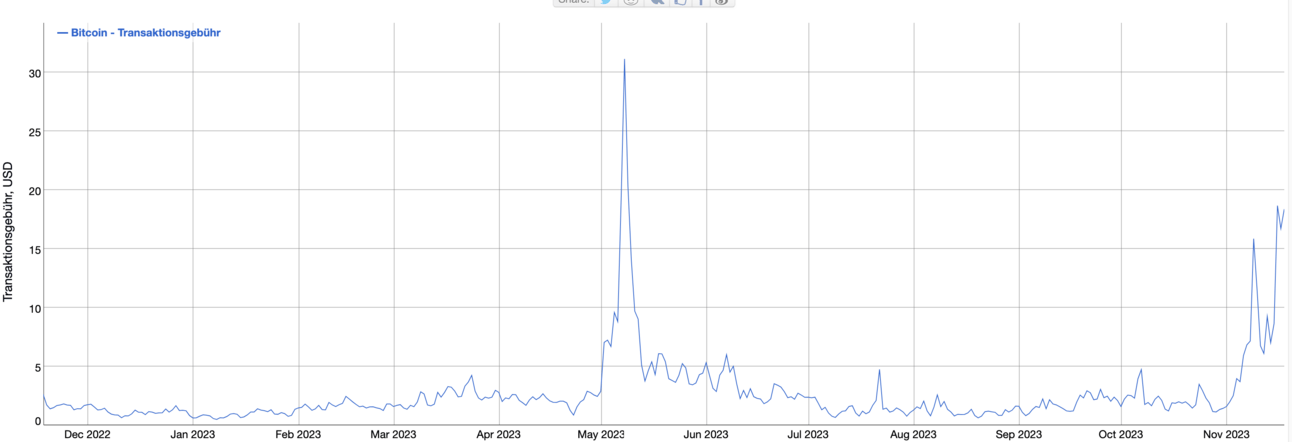

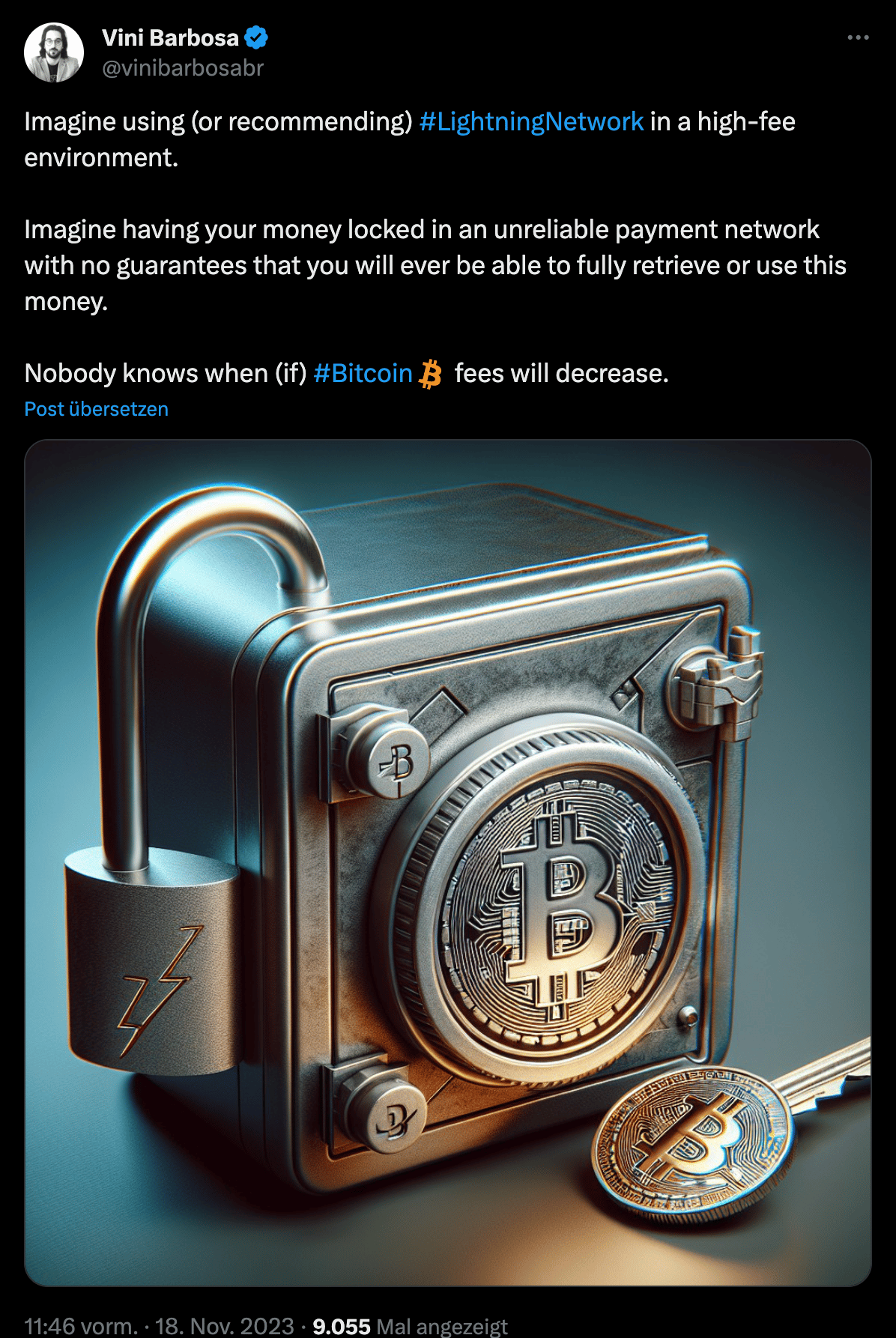

BTC transaction fees are on the rise due to Ordinals again.

Higher fees = higher incentives to mine = more security

But there’s a problem for the Lightning Network in high fee environments. It just doesn’t work properly!

Fortunately, there’s a lot going on in the BTC L2 world.

DeFi Updates

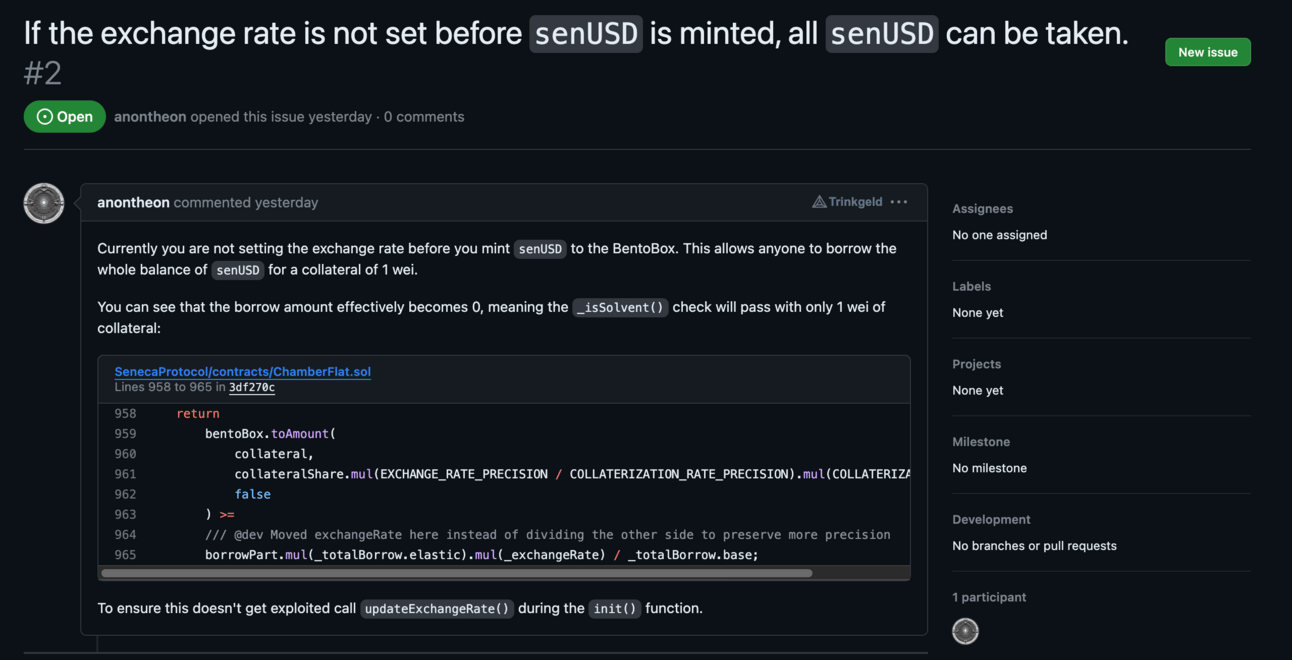

Seneca is launching on Monday Nov. 20th. You know I’m a big fan of CDP projects and I believe SEN can become a great one.

However, I don’t like buying token of a project, which hasn’t launched a properly functioning product.

There could be some serious security issues in the code. I’m not a coder, so I can’t tell how serious it is, or if it can be fixed until launch.

But I’d be very cautious and if you want to ape into SEN, then please only use a little gambling money.

History taught us that you can NOT trust a team, no matter how slick they communicate!

With all the best intentions, please, please consider pushing back the launch to not risk getting exploited.

Resolve your licensing issues, continue your security process and try to address all potential vulnerabilities before moving forward.

— 0xnevi (@0xnevi)

9:28 PM • Nov 15, 2023

It’s farming season, bitches!!

High APRs wherever you look 👀

It's not even close to peak bull, but there're so many great farming opportunities!

Here are my current favorites...

Don't forget to let me know what you're farming!

1/11

— mysexylife.eth (@My_SexyLife)

11:54 AM • Nov 16, 2023

Foxi with a good thread about re-staking picks.

Imo the narrative hasn’t really started yet.

You will never get ahead of others, if you follows majority

Missing $SOL is fine. When most KOL are calling it, you’re not gonna earn big.

That’s why I’m introducing EigenLayer Ecosystem to you, very few mentions.

Alpha Inside, DYOR and be success. 0/15 🧵

— Foxi.eth 🦊 (@Foxi_xyz)

8:50 PM • Nov 13, 2023

LandX quite an interesting RWA project. Private launch on Nov. 20th.

LNDX will be the governance token and holders are eligible to earn trading fees. Beyond members of the DAO can become farmland validators.

They’re building for a very long time already and the team seems capable. It might not look like the most attractive investment in the current market, but when markets become crappy again, it’s gets very appealing.

The wait is finally over.

Your chance to get in on the ground floor is here.

$LNDX is launching 🚀

— LandX (🌽,🌾) (@landxfinance)

12:00 PM • Nov 18, 2023

GOOD TGE on 27th

Until then you can still provide liquidity to ezVaults and earn GOOD incentives.

1/ Good Entry Wins When We Let GOOD People Win.

After multiple iterations and finding PMF, the team is proud to announce its TGE on 27 November 2023 ⛳️

Here's why a token makes sense 🎉🧵👇

— Good Entry (@goodentrylabs)

11:30 AM • Nov 1, 2023

HMX’s HLP became very attractive with its change to also cash in on GM pools. Now also ARB STIP rewards!

The $ARB rewards from @arbitrum STIP to $HLP are now LIVE 🟢

If have deposits in $HLP, you will now earn:

🔸 GMX's revenue (from $BTC & $ETH GM pools)

🔸 HMX's revenue paid in $USDC

🔸 $esHMX emission rewards

🔸 $ARB rewards from STIPClaim here 🎁:

hmx.org/arbitrum/earn— HMX 🐉 (@HMXorg)

8:58 AM • Nov 17, 2023

Investing

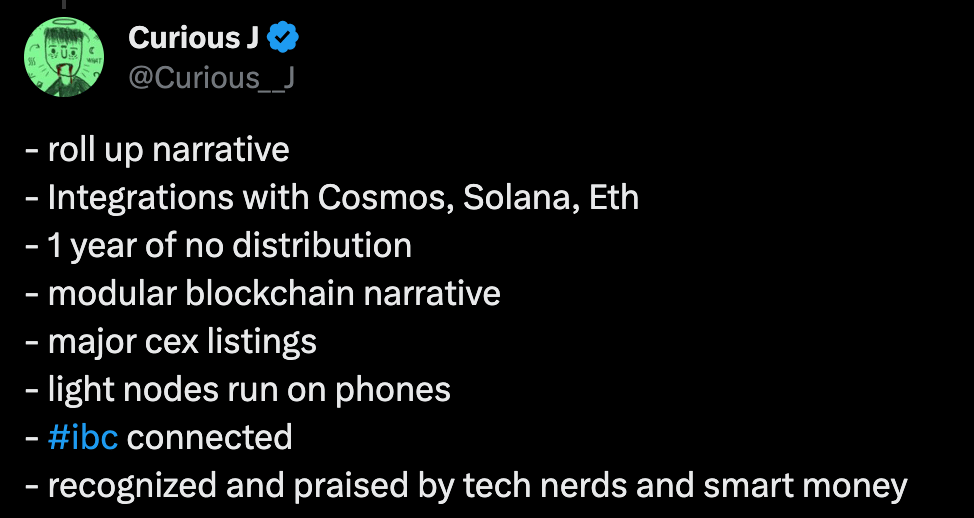

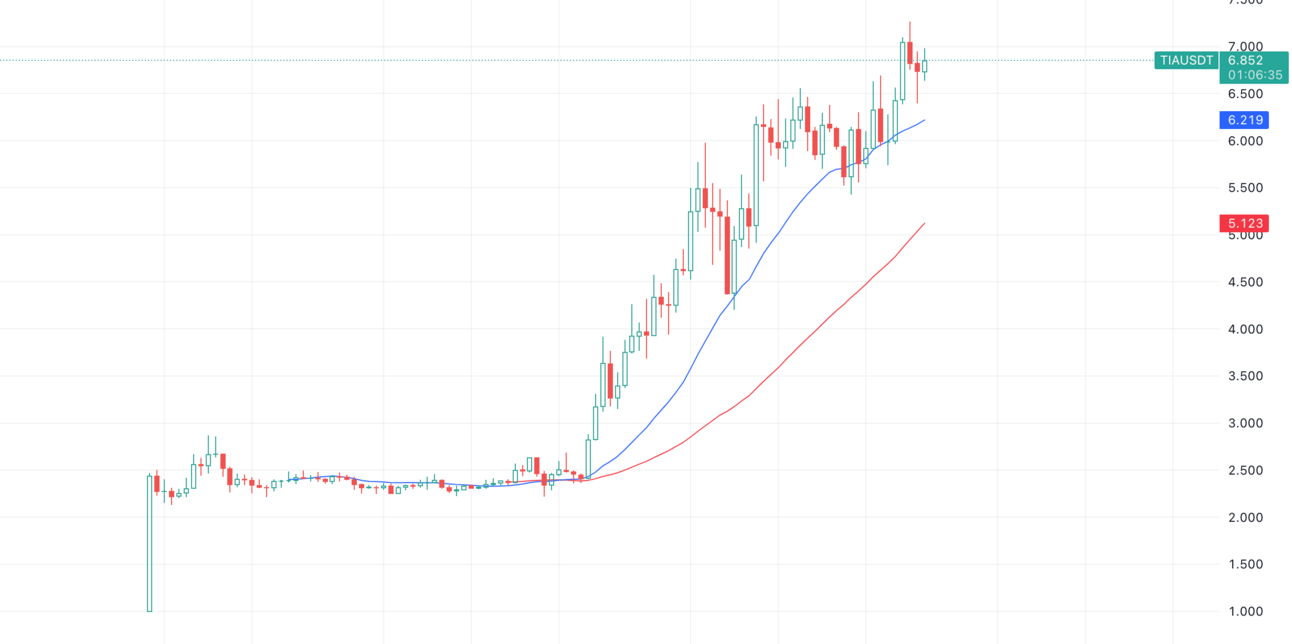

Some call Celestia the SOL of the next bull and I don’t disagree.

Besides the the points Curious__J mentioned, which I think don’t matter much, I believe it has the potential to become a front-page coin.

What do I mean with that?

Do you remember ADA? Yes, that coin, which barely delivered anything… but it has the “best tech”, “solution to ETH’s problems”, etc.

The reality is that dApps on Cardano suck ass and there’s not much going on when you check on-chain data. Not saying this can’t change btw.

It’s just a big YouTube and normie coin and that’s exactly my thesis for TIA.

If it will deliver, even better!

So I hope, you cashed in a good Airdrop. Mine is already worth ~$4k and I’m staking one half and waiting for liquid staking for the other.

Is it already too late to buy in now?

Well, if it really becomes the next SOL, definitely NOT. If you have no exposure at all and you have some funds on the side, it might be a good move to get a smol bag. I’m going to use setbacks to get a little more.

A 10x is easily achievable from here. Compared to ADA, which almost hit $100B in the last bull, it could perform even better if my thesis plays out.

If you feel uncomfortable to get in NTRN could be a good beta play, which hasn’t lift off yet.

I wrote an investment memo on @Neutron_org & why $NTRN is a fundamentally undervalued liquid token investment and a higher beta to $TIA and $ATOM

check out the full memo here: medium.com/@rpatel1443/ne…

summary🧵on fundamentals, catalysts, price predictions, & risks

— Rahul Patel ⚛️ (@The_Pleb_VC)

9:04 PM • Nov 14, 2023

Macro

The gov has to pay a premium so investors buy treasuries. And this premium was around 5bps, which is seen as catastrophic.

This can be seen as another sign that things are going to break. This might not be in the next weeks, but I expect that the economy takes a hit in the next 6 months, which means recession.

But markets can still run hard until that happens. So if you’re too pessimistic could let you miss a lot of gains.

But not only countries are in deep debt, the average person is as well.

We’re basically in an enormous debt crisis, which is about to implode.

• Household Debt: $17.3T

• Credit Card Debt: $1.1T

• Auto Loans: $1.6T

The Reverse Repo Facility experiences significant outflows.

Joseph Brown notes that with only $1.3 trillion left in the facility (down from $2.3 trillion six months ago), and with the pace of government borrowing increasing, there could be significant consequences, including much higher rates.

This would become even worse for the debt crisis.

The Reverse Repo facility has seen $1 trillion drain out in just the last 6 months

What happens when it runs out?

Its important to remember what this account is for, and where this money came from in the first place 🧵👇🏼

When all the money printing started in 2020, this… twitter.com/i/web/status/1…

— Joseph Brown (@heresyfinancial)

6:23 PM • Oct 5, 2023

Stay Sexy!

I’d appreciate if you give me some feedback and what you like to read in this newsletter, so I can provide the best value for you! Just send me a DM on X or reply to this mail.