- Mojo Report

- Posts

- Mojo Report #13

Mojo Report #13

Cliché Americans

Mojo Report #13

Your weekly DeFi update. The good stuff, but not financial advice!

The mechanism how the system around fiat work, how central banks and treasuries operate is very similar to how Europeans picture the Chliché American.

Americans are seen like hillbillies gone wild, swiping their credit cards for useless stuff and living entirely on debt. And to finance this lifestyle, they get a new card to pay off their debt from the old card.

The average American has looped debt at least 10 times and owns 15 pieces of plastic.

And that’s basically what these institutions do. They issue bonds to finance useful, but also a lot of useless things. When the old debt matures, new ones are issued. Of course, for extra need of money, extra credit cards are issued.

This works fine as long as there’s someone who’s willing to buy the debt.

On-Chain Look

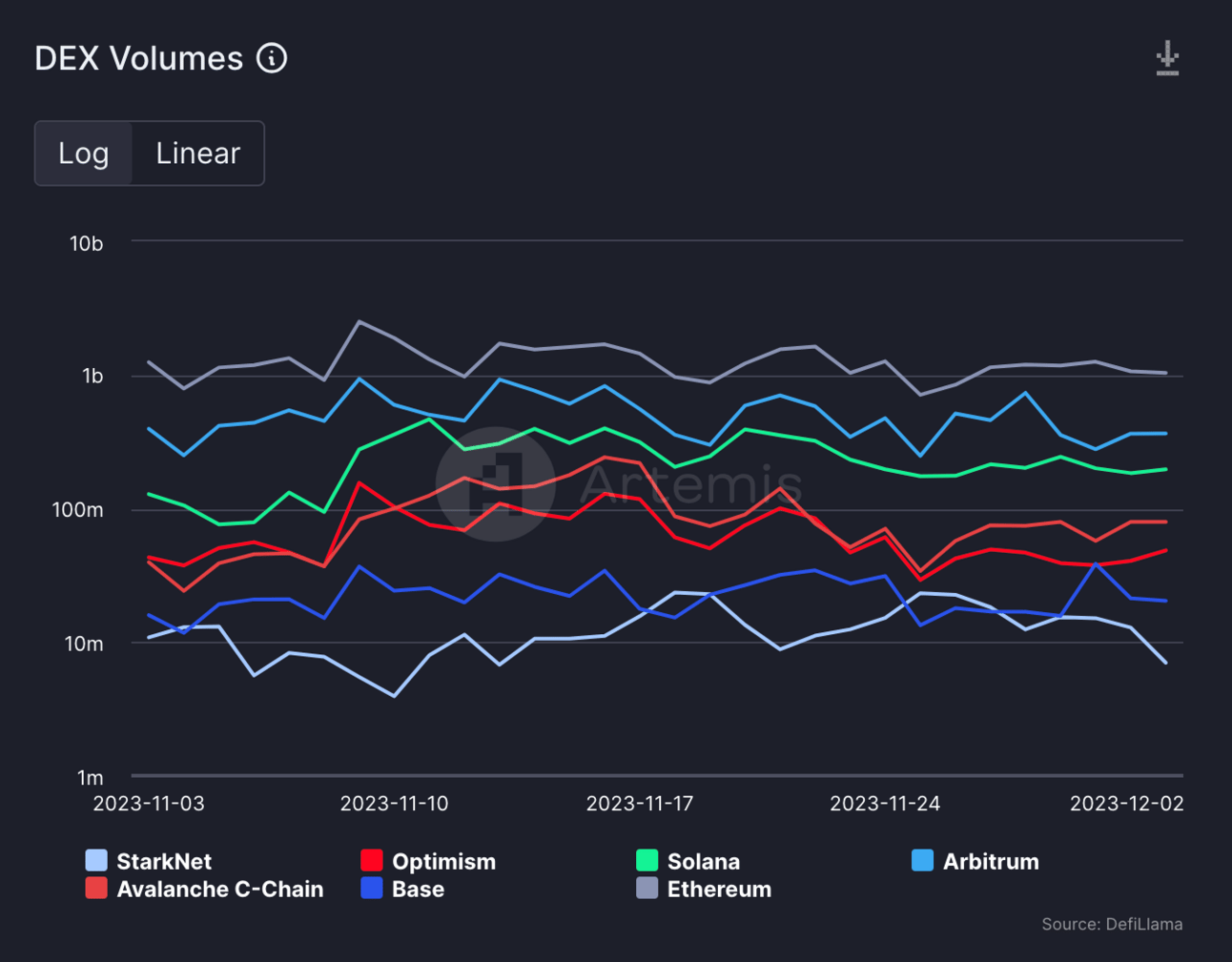

Solana is currently the chain with the most active addresses and txs. Since October, it’s also ramping up the DEX volume.

The narrative is hot and might be taken into the bull.

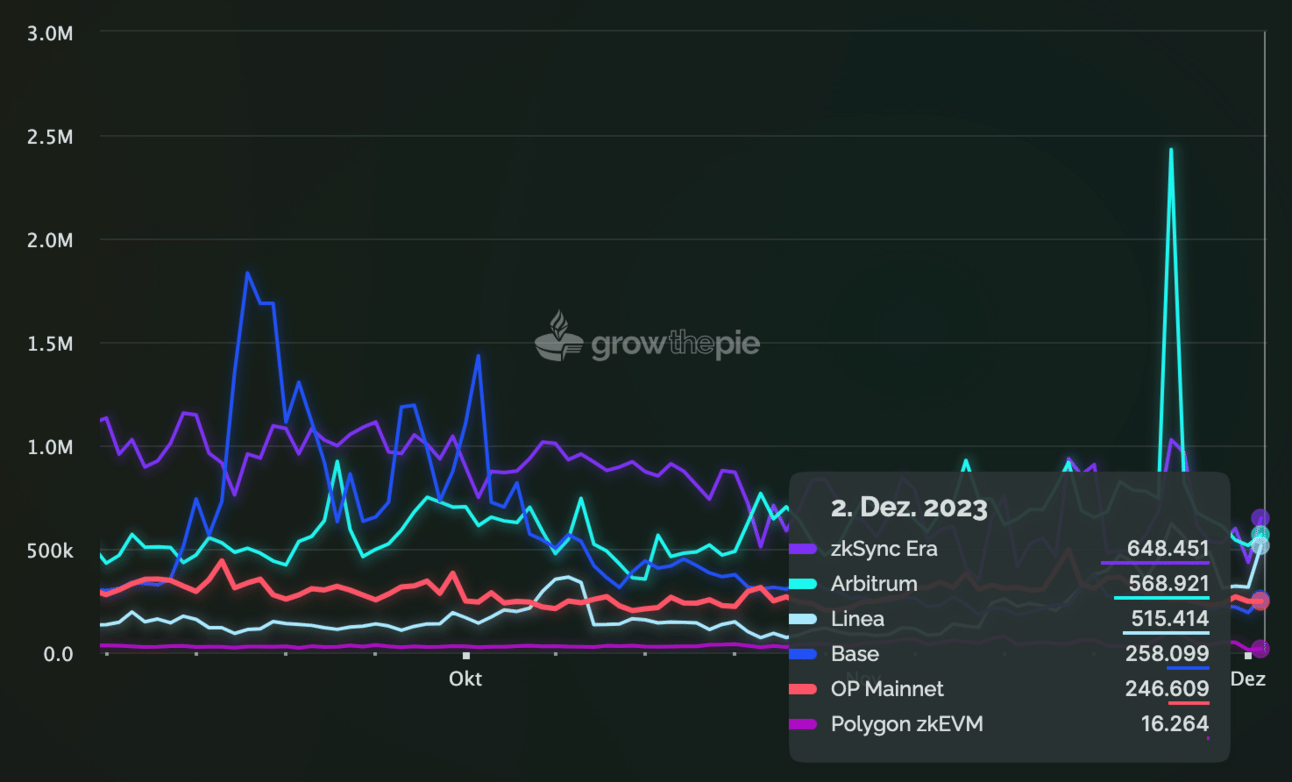

A big rise in txs on the Era and Linea rollup, which are likely Airdrop hunters. (With a small wallet I’d focus more on the not so obvious drops.)

Mantle’s txs count can be found in the OP area.

CEX 7D net Flows:

• only 2,005,700 BTC are left on CEXs after ~17k left this week

• basically no change in ETH supply on CEXs (-0.03%), 11.5k have been burned

DeFi Updates

Seneca pulled their launch because of security reasons. (I reported)

It’s def a good move and makes me feel better about the project. Nevertheless, I’m not buying a token which has no properly functioning protocol.

SEN is ranging between $0.2 and $0.3 and I think it won’t leave it until shortly before launch.

Seneca's strength lies in its isolated debt model.

To ensure maximum safety, Seneca is currently undergoing an extensive audit of the CDP infrastructure.

The final report will be shared as soon as the security reviews are completed.

More details coming soon. 🏛️ twitter.com/i/web/status/1…

— Seneca (@SenecaUSD)

7:42 PM • Nov 29, 2023

I don’t necessarily agree with supply has much effect on the price as it’s always been promoted, but demand for sure has.

Demand is always the driving force and when supply goes down it has a leveraging effect, but supply has never an effect on its own.

That’s the reason why token burns and locking mechanisms don’t always work btw. Supply is a meme and burns are often only a marketing move.

In the case of ETH it’s real. The demand will be insane.

The ETH thesis is so simple, it blows my mind nobody's talking about it.

ETH supply vs. ETH demand: One is going down, the other is going up. They are both reflexive and when we enter a bull market, it will become a lot more clear but let me break it down for you:

— DecentMuse (@DecentMuse)

5:31 AM • Nov 28, 2023

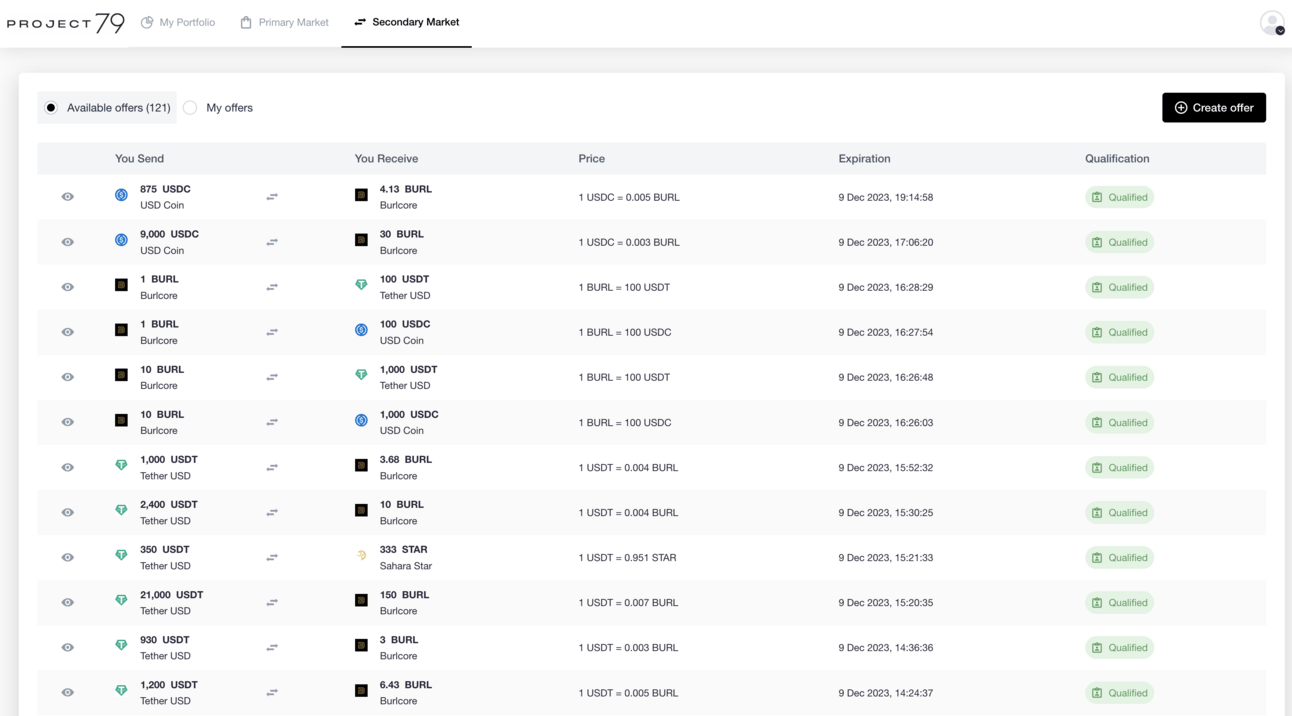

The Project79 market place went live!

It allows to trade tokenized shares of goldmines and explorers. But you have to KYC to trade on the platform.

Holding BURL token also brings cashflow from the mined gold, which varies between $1.5 - $3.5 per token and month so far.

Here’s some really good data on the 161 wallets that invested $1.5m within 1min in the Good Entry IDO.

.@goodentrylabs raised 1.5M in under 20 seconds

Bullish on $GOOD

but sour I was not able to get into the at the same timeSo I made a duneboard on their IDO & looked into the data

and here's what i found— Good Data Bad Guy 🧑🍳🥩🤌 (@GoodData_BadGuy)

3:52 AM • Nov 28, 2023

I’d be careful with such calculations! It’s good to have a thesis, but what if RUNE “only” goes to $80 and you won’t sell because it must go to $100?

My first target for RUNE is $50 when I’m going to start selling a part (I might start earlier, if things get ugly). But still, I always hold a smol moonbag.

Is $RUNE to $100 a meme? Valuing $RUNE using the 3x TVL Design ⚡️

This post will serve 2 purposes; to explain how the 3x TVL mechanism accrues value to $RUNE and to provide some scenarios for estimating the future token price.

So let’s go 🧵

(Hint: It’s not a meme)

What is… twitter.com/i/web/status/1…

— Spot Wiggum (@SpotWiggum)

5:26 PM • Nov 27, 2023

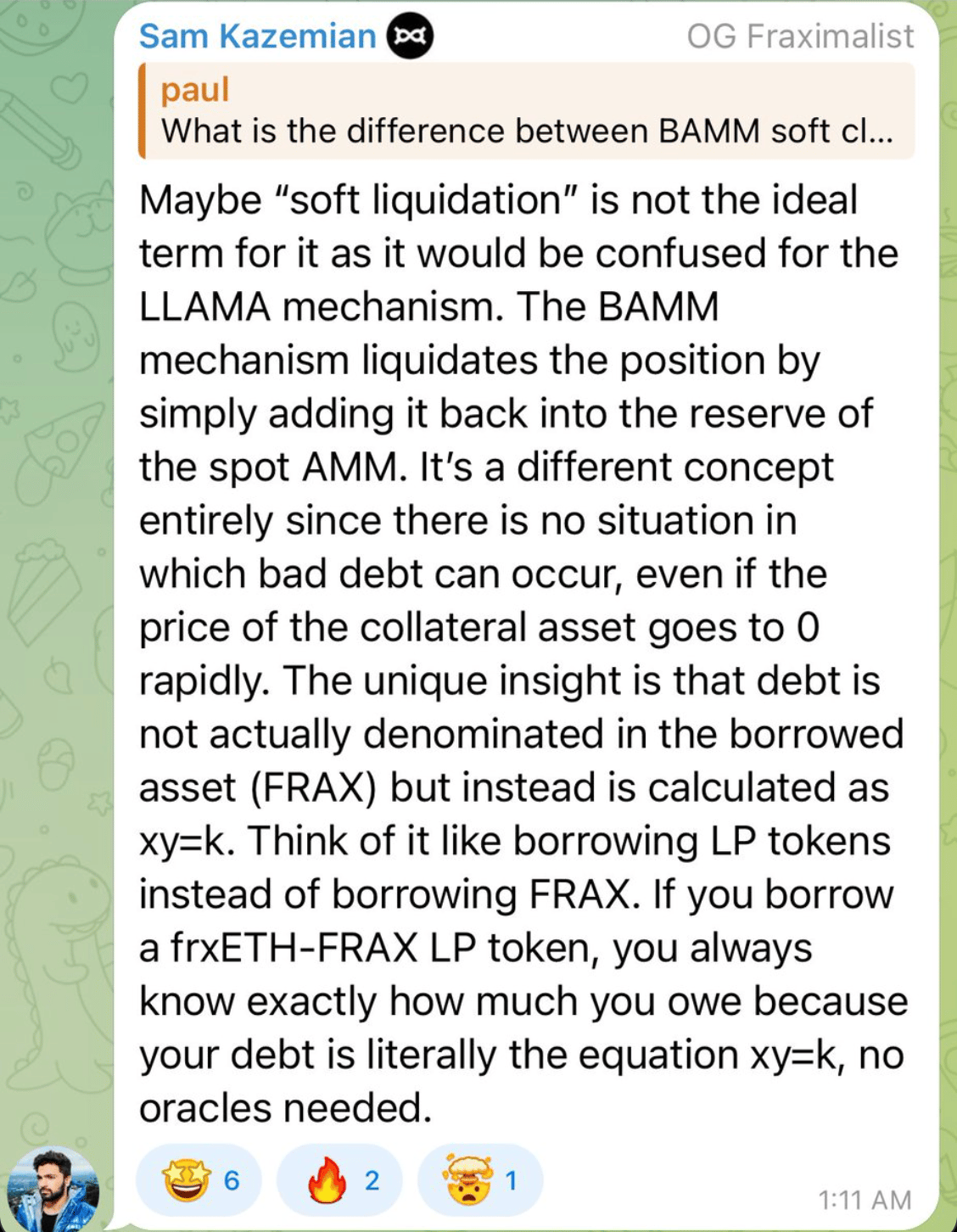

Frax is one of the most overlooked projects currently. Might be due to their bad marketing.

It doesn’t mean it’ll happen again, but FXS pulls a 3-4x after every halving. To be fair, there haven’t been too many yet. But with the upcoming catalysts, the probability is very high for a pump.

$FXS is flying so deep under the radar rn!

Upcoming catalysts for @fraxfinance

🔸️ Halving

🔸️ FraxChain

🔸️ BAMM, which allows oracle free leverage for any token (only on FraxChain)— mysexylife.eth (@My_SexyLife)

10:31 AM • Dec 2, 2023

BAMM is also a very interesting concept, which reminds of the crvUSD mechanics. But it’s completely different, when you look deeper.

BAMM allows oracle-free leverage for any token and you basically borrow from an LP.

Octopus created an amazing dashboard, which tracks what new wallets are buying. This is very helpful since those are overseen and most only track already known wallets.

Here's the link to the dashboard:

— Octopus 🐙 | Defi Insight (@defi_octopus)

2:01 PM • Nov 20, 2023

Investing

So far it looks like we’re having a year end rally. But can we keep up in January?

At some point, we definitely get a correction. How strong will it be? Nobody knows. But it’s very likely this will happen in Q1. Funny enough that it would be in alignment with other cycles.

Here’re some theses for an occuring dip:

BTC Spot ETF will be approved

This could be a buy the rumors sell the news. If you think all of a sudden trillions of dollarinos will flush the space, just because an ETF is available in the US, you’re wrong.

Yes, liquidity will come, but institutions won’t hammer the buy button immediately. It will take time.

In this case however, the dip won’t be too crazy.FED Pivot

I explained it here 👇For the Apocalyptitians

https://x.com/My_SexyLife/status/1729816254716727549?s=20

How do I play that?

I’m a strong believer that we get a good correction. Therefore, I think that we get another good chance to buy.

I cut my regular DCA buys by a half to save some cash for the dips. But I’m in a good position to do that, because I’ve been accumulating the whole bear. If I’d be sidelined until now, I’d behave completely different.

There’s already liquidity flowing in and sentiment has changed. That means, it’s definitely time to take more risk during the end rally. You should only have a potential dip in Q1 in mind, to be ready to pull out.

Macro

People acting completely irrational and buy stuff they can’t afford. This tells us a lot about the psychology and the state we’re in.

This kind of behavior appears, when people are already resigning. The skewed gov data doesn’t represent reality if you haven’t recognized yet.

BREAKING: Buy Now Pay Later spending soars 20% compared to last year on Black Friday.

It's also expected to jump 19% on Cyber Monday to a record $782 million.

As excess savings in the US have gone from $2 trillion to zero, Americans are relying on debt more than ever.

In other… twitter.com/i/web/status/1…

— The Kobeissi Letter (@KobeissiLetter)

2:54 PM • Nov 27, 2023

But this doesn’t necessarily mean markets won’t perform well. They’ve decoupled from reality a long time ago.

The real losers will be people, who can’t afford to invest. But this has a strong impact on society and stability of countries.

“Oh Sexy, you’re a doomsday caller!”

No, I’m not! But if you walk around with open eyes, the change is already visible.

You know what this means, if you’ve read my previous Mails. Definitely something to keep an eye on!

$768 billion left in the reverse repo facility

— Joseph Brown (@heresyfinancial)

4:08 PM • Dec 2, 2023

Stay Sexy!

I’d appreciate if you give me some feedback and what you like to read in this newsletter, so I can provide the best value for you! Just send me a DM on X or respond directly to this mail.