- Mojo Report

- Posts

- Mojo Report #19

Mojo Report #19

Last Man Standing

Mojo Report #19

Your weekly DeFi update. The good stuff, but not financial advice!

Finally, we got a dip!! And suddenly I see so many on my TL with extreme emotions and in fear.

Come on! We ran up like crazy, such a dip is healthy and completely normal. I took the chance and went on a shopping spree already.

Only with controlling your emotions, you’ll be the last man standing. Everybody else won’t make it. Be a psychopath if you have to, of course only when it comes to the markets!

It seems like the ETF flows have an effect on the markets. Of course, this is just an indicator, but I keep an eye on that.

Heavy outflows from GBTC in the last two days and inflows to others slowed down a little. I expect more waves of inflows, which result in a more constant but not so violent flows in the next months.

The meta in this cycle is obviously points farming.

However, points are just a proxy to the actual tokens itself. And dependent on how the different campaigns are carried out, they can give you an advantage if you’re not a whale. A linear distribution is similar to farming the token, wether a tier system can reward you with an above average return.

The EigenLayer airdrop is probably the hottest one in 2024 and if played right, you could make a fortune with it. Points are already traded up to $0.17 on the pre-market.

However, everybody is anticipating and working toward this drop. That means, if you don’t have the right strategy, you won’t cash in big.

Leverage is definitely your best friend here!

Of course, you could also accumulate points on the market. But we don’t know if the current prices are already expensive or not. Nevertheless, we want as many points as possible in the end.

Another thing that should be mentioned is that you should concentrate your funds. A little playing here and a little there won’t bring life changing drops (if you don’t have a huge portfolio already). Rather concentrate 80% on your funds on a few very promising projects and the other 20% on

In the following I’ll mention some of the activity, I’m involved in and how you can leverage your chances.

EigenLayer

The biggest one first. There’re many ways how you can push your point earnings.

Pendle is probably the most obvious one. Here you can easily build a big leverage on points earnings.

But you should be aware that YT is getting worthless at maturity.

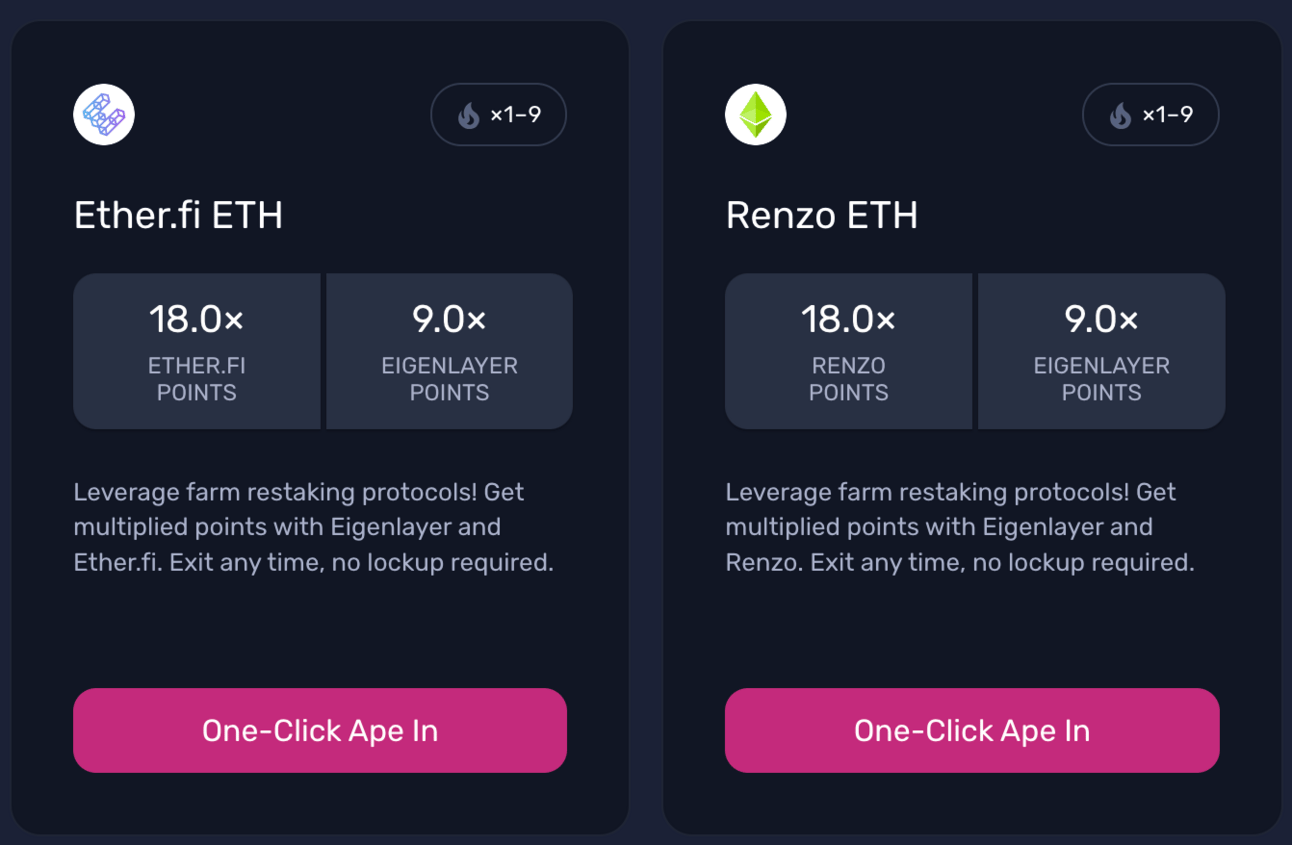

Gearbox provides another great function of leveraged EL points farming.

Currently, borrowing rates are quite high with ~22%, but this shows how much demand exists.

If you’re lucky and find an open window to get into Stella’s hyper pool, you can leverage your eETH exposure and earn some ARB on top. Unfortunately, I couldn’t manage to get in yet.

Mantle restaked 100k of its mETH and is going to pass it down to mETH holders on its L2. So looping your mETH on Mantle makes sense.

However, the supply on the L2 grew a little after the announcement and it looks like it’s stable with a little more than 102k. But we have to take the treasury mETH with ~20% into account.

Timeswap’s wETH/mETH pool is a great way to loop your mETH, when the rates are low to lock in a fixed APR. And with the double yield, it’s extra lucrative.

I looped my mETH 6x with Timeswap and swapped the remaining ETH for mETH again and deposited it into Circuit for some extra MNT rewards. I got in very early and got a fixed rate <2%. That means I’m earning a net staking yield of ~35% + EL points + TIME and MNT rewards.

With fixed ~2.5% interest, looping $mETH on @TimeswapLabs is sexy again.

Yes, the definition of fixed is that it won't change once locked in.

— mysexylife.eth (@My_SexyLife)

11:29 AM • Feb 28, 2024

Other money markets like Lendle and Aurelius (currently also has a points program running) can also be good for doing a little looping.

Aurelius also lets you mint aUSD against your mETH interest free. The current dip might be a good chance to also leverage your ETH exposure while farming EL points.

INIT also has a feature, called hook, for that. You might want the points, since it’s one of the more hyped protocols on Mantle, but imo it’s over farmed already.

On Gravita, you can get interest free loans and mint GRAI against your mETH. You can either buy more mETH with it and get leverage on your ETH exposure on top or use it for other stuff.

I swapped some of my GRAI for USDY (yield bearing token with ~5%) and deposited it into Minterest, where you earn 15% MINTY and 12% MNT rewards for supplying.

The other part went into Cleopatra pools, where you can earn some outrageous APYs at the moment. The rewards mainly in form of xCLEO, so this is only interesting if you’re interested in participating in a ve(3/3) DEX

BLAST/Mode

Blast and Mode are extremely good ecos for collecting multiple points.

e.g. Sturdy

Supply weETH, borrow wETH and deposit it into the Renzo aggregator.

This way you earn EL, 2x Mode and 2x EtherFi points for your collateral and another 2x Mode and 2x ezPoints + STRDY and 26% yield in the aggregator.

You can basically do similar things in most projects running on Blast and Mode. You just have to watch around where you can get the best rates (we don’t want to burn money for some points).

Here’s what I’m farming:

- Mode: Sturdy, Ionic

- Blast: Hyperlock, Init, HMX Surge, NFT Perp

Mantle

Mantle is coming with MNT staking soon. Besides EL points via mETH you can earn Ethena shards by staking MNT.

In my opinion, the whole eco is under farmed and a lot of money can be made there. And they won’t stop delivering such things any time soon. They have more runtime than people can fade the eco.

I’m currently farming:

Timeswap (multiple chains), Aurelius, Init, Gravita, KTX, Minterest, Lendle

Get ready for a brain teaser! 🧠⏱️

Coming soon:

🥩 Stake $MNT

🔓 Unlock @ethena_labs Shards

🚀 Trade it across Mantle's robust DeFi ecosystemShare your answer in the comments 👇

— Mantle (@0xMantle)

2:10 PM • Mar 20, 2024

Solana

It looks like Solana will crush it this cycle and with it the eco-system grows, too.

I was farming Kamino, but after they announced a linear distribution, I took out some of my funds and deposited them into Parcl.

I have been very early on Parcl and therefore, I got a nice boost with 20% on my positions. If you’ve missed Parcl, you can get 50k points as a liquidator, which could bring you back into the game.

I also wouldn’t fade Jupiter’s second drop. Locking JUP and vote, trading, depositing funds are the activities to do.

I also staked some PYTH

Cosmos

This is probably the easiest space to get airdrops. Just stake your token or hold liquid staked token.

My stake:

- ATOM + stATOM

- OSMO + stOSMO

- TIA + milkTIA (points program) and stTIA (STRD airdrop + high probability for other airdrops)

- DYM + stDYM

- I unstaked my INJ. It hasn’t been a lot anyway and I’m not very bullish on it

I’m also active on Arbitrum, Optimism and I’m also checking out Aptos recently (Merkle Trade and Thala are my go to dApps).

I’m not doing much on zkSync anymore. I think the airdrop will disappoint. Have been active in the beginning and just doing some “necessary” activity just in case.

Investing

I sold half of my stablecoin stash already. Yes, it could drop further. But if not, there’s a chance of the next violent leg up. However, my preferred scenario would be a side market for 2 or 3 months.

Here’s what bags I’ve secured:

- Pendle (probably the best r/r coin you can buy rn)

- MNT (staking soon)

- NMT (the recent incident caused a significant drop)

- Winr (expansion to Solana)

- Pica (will be a restaking layer for Solana, not much talk about it yet)

- NGL (I just have a feeling here. Sometimes you have to go with your guts)

Entangle $NGL roadmap is insane: mainnet and staking in less than one month, and a whole ecosystem of apps and new tokens (including gaming, DePin, meme coins) launching soon. And if you read between the lines, all these should be airdropped to $NGL stakers. Send it much higher.

— Rafi_0x (@Rafi_0x)

2:36 PM • Mar 14, 2024

Macro

Did you know that passive investing sucks? Well, I actually want to shit a little bit on our monetary system here.

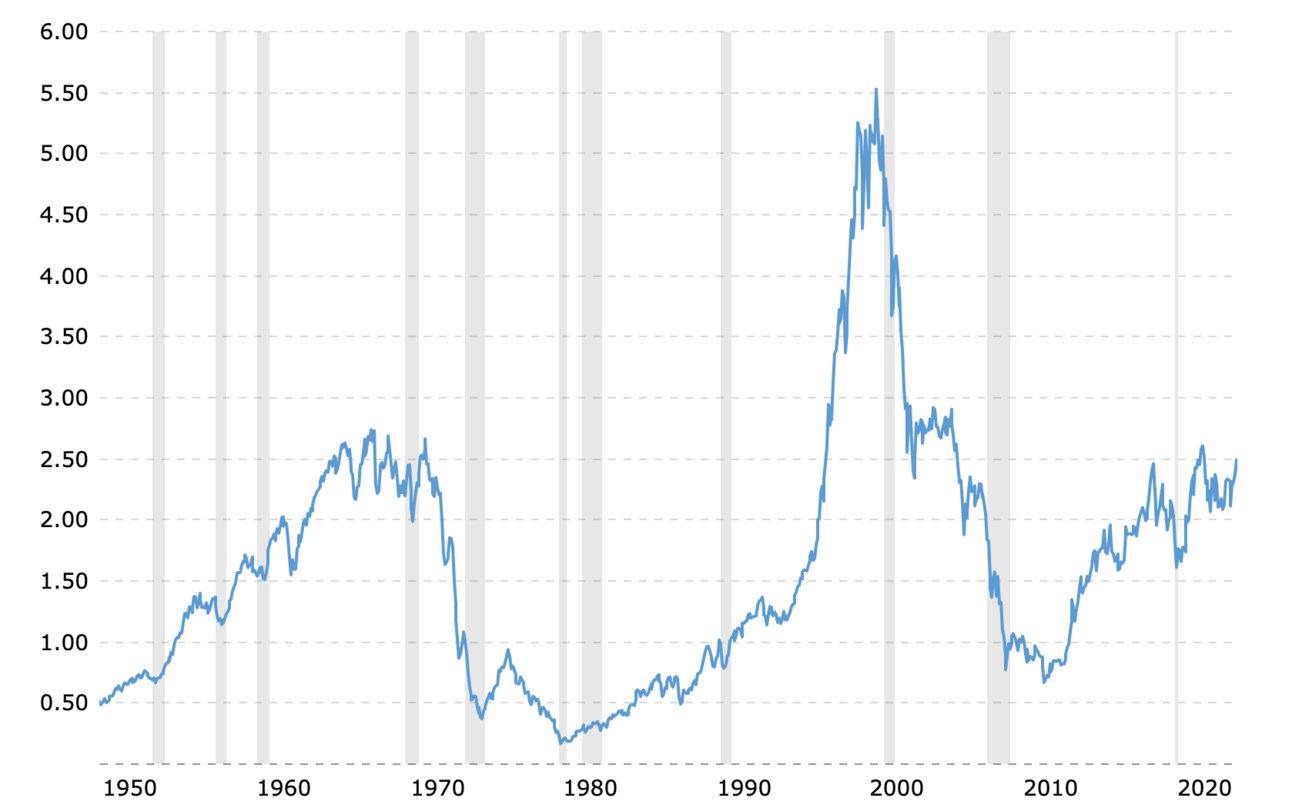

Below you can see the S&P500 to Gold ratio, so the S&P priced in Gold. You can see that it stays pretty much flat with some peaks and lows.

The thing is, if you inflation adjust the gold price with the 1980’s formula, you would be down since 1950. Yea, gold hasn’t outperformed inflation over a longer period and how far behind it is from its ATH.

With this example, I want to show you how real currency devaluation is. Of course, if you would be active in this period, this whole thing would look different. Just a few S&P500 to gold and back trades once in a while made the difference.

Here are some of my ref codes. If you’re interested in using some of these projects, I appreciate when you use my code!

Rabby Wallet (Best EVM wallet):

https://rabby.io/rabby-points?code=SEXYLIFE

Aurelius Finance (CPD and Lending):

https://app.aurelius.finance/?af=sexy

INIT Capital (Lending):

https://app.init.capital/points?ref=5ECC4D

Spot On Chain (Analytics Platform):

https://platform.spotonchain.ai/referral?code=0r3wi0eg6n33

HMX (Perp Trading, Arbitrum, Blast):

https://hmx.org/arbitrum/referral?ref=SEXYLIFE

Merkle Trade (Perp Trading, Aptos):

https://app.merkle.trade?ref=ISEOW51X

NFT Perp (NFT perp trading, Arbitrum, Blast):

https://app.nftperp.xyz/referral?code=DCAA40EE

Parcl (Real Estate Perp):

mojolife

Stay Sexy!

I’d appreciate if you give me some feedback and what you like to read in this newsletter, so I can provide the best value for you! Just send me a DM on X or respond directly to this mail.